Governance

Corporate Governance

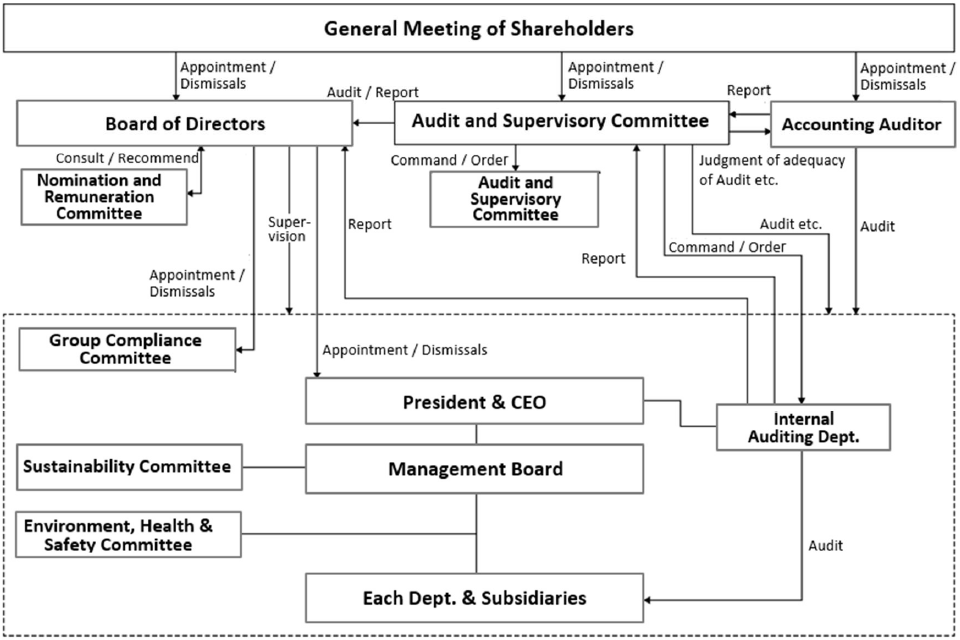

MODEC establishes its corporate governance system in accordance with the fundamental principles of strict compliance, a focus on shareholder returns and securing business transparency.

Corporate Governance Guidelines

The purpose of the Guidelines is to set out the basic framework and philosophy of the Corporate Governance of MODEC and to contribute to the furtherance of the sustainable growth and corporate value of MODEC.

Corporate Govenance and Internal Control System

Corporate Governance Report

MODEC, Inc. ("MODEC") has presented the following report to the Tokyo Stock Exchange describing the status of MODEC’s corporate governance.

In accordance with the Corporate Governance Code, the Board of Directors conducts a self-assessment of its effectiveness. A summary of the results of the assessment is presented below.

Compliance, CODE

Code of Business Conduct and Ethics (CODE)

MODEC Group has developed the Code of Business Conduct and Ethics (CODE) to ensure that all directors, officers, and employees working on behalf of MODEC Group companies will follow the ethical and legal standards that apply to our work. In addition, we expect our business partners who act on MODEC Group's behalf - such as suppliers, contractors, consultants, and temporary workers - to abide by the standards of our Code.

The CODE is provided in seven languages (English, Portuguese, French, Spanish, Chinese, Vietnamese and Japanese) to help each local employee obtain good understanding by reading in his/her native language.

Group Compliance Committee

The Board of Directors of MODEC establishes the MODEC Group Compliance Committee for the purpose of assisting the Board in overseeing the Company and its subsidiaries' compliance with applicable laws and ethical standards that may impact the MODEC Group's business operations or public image; and monitoring and overseeing management implementation of policies and procedures to promote compliance with such laws and standards ("Compliance & Ethics Program"). The membership of the Committee consists of CCO and a member from the senior management of the Company, Officers from the Company's key subsidiaries and Legal counsel. An Audit and Supervisory Board Member is invited to join as an observer.

Compliance Training

The MODEC Group conducts training on Anti-Corruption Compliance and the CODE through e-learning system for our directors, officers and employees once a year. In parallel, as deemed necessary, local face-to-face compliance trainings are conducted to fulfill local requirements and needs.

MODEC Ethics Hotline

The MODEC Ethics Hotline is a global compliance and ethics reporting system whereby members of the MODEC community can report suspected legal or ethical violations. The system is operated by an independent third party and is available 24 hours a day, 7 days a week, and 365 days a year. The MODEC Group is committed to safeguarding each reporter's right to anonymity, provided it is allowed by local laws, and will review reported concerns in a prompt and confidential manner.

Risk Management

Overview

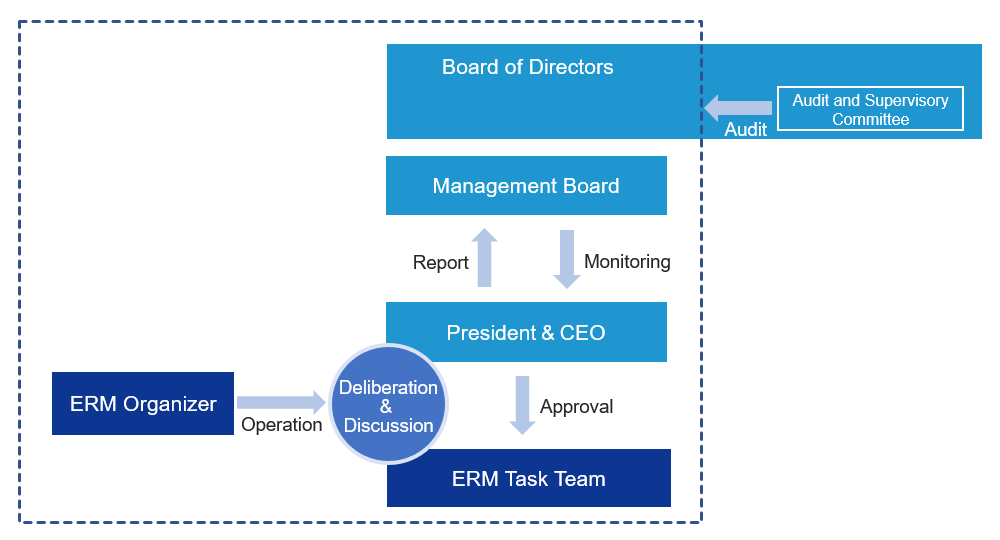

The MODEC Group prepares and operates a risk management system based on the "Regulation for Risk Management" and its related regulations. Risk management activities are divided into Enterprise Risk Management (ERM) as a preparation for potential risks, Response at the Occurrence of the Crisis in the Company Group, and other business risk actions.

In addition, identified risk review team is organized when we identify risks which have a potential of significant impact on company management or are approved by President & CEO as risks require special attention. Board of Directors Meeting (BOD) and Management Board (MB) monitor the ERM, and regularly receive reports from President & CEO regarding the significant risks, and the progress and the implementation results of the responses.

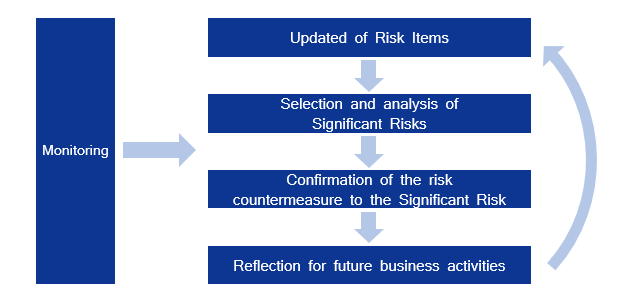

We recognize all internal and external factors that adversely affect its management, such as finance loss, loss of brand image, discontinuance or suspension of our business activities, climate change, as a risk. In order to manage them, we are grasping the serious risk of the whole company and implementing countermeasures systematically and on a scheduled basis according to priority.

Risk Management Structure of the MODEC group

We prepare for the crisis such as natural disasters and categorize into three levels; Emergency (Level one), Regional Crisis (Level two), Group Crisis (Level three), and control the crisis based on its level.

Under the supervisions of Board of Directors, we monitor "CSR (ESG) Risk" as one of the categories of "ERM Risk Scenarios", and assess its impact with reviewing it regularly.

Risk Management Process of the MODEC group

- Example of CSR risk (ESG risk)

-

Biodiversity conservation, Climate change, Water Use, Pollution and resource management

Accountability for Stakeholders, Health and Safety, Human rights and Local Communities, Labor StandardsTax Transparency, Anti-Corruption, Corporate Governance

Anti-corruption

The MODEC Group is committed to preventing bribery and to complying with the various anti-corruption laws that apply to our operations around the world. These laws include the Japan Unfair Competition Prevention Law, the U.S. Foreign Corrupt Practices Act, and, where applicable, the U.K. Bribery Act of 2010, as well as the laws of all countries in which the MODEC Group does business. It is the policy of the MODEC Group to comply with applicable anti-corruption laws and to conduct business in an ethical and professional manner.

All third party Intermediary and Business Partner (TPI/BP) that work on behalf of MODEC Group are required to comply with the various anti-corruption laws that apply to our/their operations around the world. All TPI/BP agreements must include the anticorruption contractual provisions provided in, or similar to, the appropriate template Anti-Corruption Compliance Provisions provided by MODEC Legal team. When deemed necessary, the MODEC Group requests TPI/BP to complete the required training and/or to execute the MODEC Anti-Corruption Compliance Certification.

Management Structure

- 1Communication and training on anti-corruption policies and procedures

The MODEC Group conducts due-diligence on Anti-Corruption before retaining or renewing an agreement with third party intermediary and business partners based on our "Vender Vetting Policy" and "Group Third Party Intermediary and Business Policy". In parallel, we conduct training on anti-corruption through E-learning system for our directors, officers and employees once a year. - 2Corruption risk assessment or management system to deal with third party intermediaries and business partners

The MODEC Group conducts anti-corruption risk assessments on third party intermediaries and business partners at the time of contract and periodically during business term based on our "Group Third Party Intermediary and Business Partner Policy". - 3Communication with third party intermediaries and business partners related to anti-corruption policies

The MODEC Group stipulates in the "Group Third Party Intermediary and Business Partner Policy" that contracts with third party intermediaries and business partners must include the anti-corruption contractual provisions provided in, or substantially similar to, the Policy.

Performance

- 1Training

The MODEC Group conducts training on anti-corruption for our directors, officers and employees once a year. In 2023, a total of approximately 7,000 employees and officers have attended this training. - 2Donation for the political parties and funding organizations

The MODEC Group prohibits the use of MODEC corporate funds or resources for Political Contributions in accordance with our "Group Social Contributions Policy."

Tax Transparency

General principle

The MODEC Group's "Code of Business Conduct and Ethics" mentions the importance of fulfilling our corporate social responsibilities through compliance with laws, regulations and various international rules (such as the OECD Transfer Pricing Guidelines for Multinational Enterprises) and adhering to ethical business conduct in accordance with social norms at our international and domestic operating locations. With respect to tax affairs, the directors and employees of our group acknowledge that it is one of our important social responsibilities to contribute to the socioeconomic development of various countries. We ensure the proper payment of tax in accordance with the applicable laws and regulations of the countries and territories in which we operate, and are committed to conducting our tax affairs in a transparent manner.

Tax risk management and governance

Within our group operating a global business, departments in charge of tax affairs are responsible for understanding tax laws and practices and identifying issues within their respective countries and regions, and strive to mitigate taxation risks. Under the supervision of the Board of Directors (BOD), the CFO (Chief Financial Officer) executes operations and reports to BOD.

We make effective use of our external advisor's expertise in relation to mitigating tax risks.

Tax planning

Based on the premises outlined in this General Policy, and from the standpoint of ensuring protection of shareholder profits, we endeavor to ensure appropriate tax payments through utilizing tax incentives to the extent that such incentives are applicable for our business activities or through eliminating double taxation.

We shall not follow a strategy of avoiding taxation through utilizing tax havens.

Relationship with tax authorities

We seek to develop relationships of trust with tax authorities through various means, for example, by using available methods to obtain certainty from tax authorities such as rulings or the use of advanced pricing arrangement programs (for international transactions).